Education

The Market’s Compass Crypto Sweet Sixteen Study

[ad_1]

Welcome to this week’s publication of the Market’s Compass Crypto Sweet Sixteen Study. The Study tracks the technical condition of sixteen of the larger market cap cryptocurrencies. I have compiled the historic quantitative objective technical ranking data and secondary technical indicators including the Sweet Sixteen Total Technical Rankings and Weekly Average Technical Ranking back to October of 2021. Every week the Studies will highlight the technical changes of the 16 cryptocurrencies that I track as well as individual highlights on noteworthy moves in certain cryptocurrencies and Indexes.

I have been asked by several of my readers to include a technical “Summary” which starting next week, will be a regular feature in the Weekly Crypto Sweet Sixteen Studies. Also, this week’s Study is somewhat abbreviated due to the travel commitments of the author.

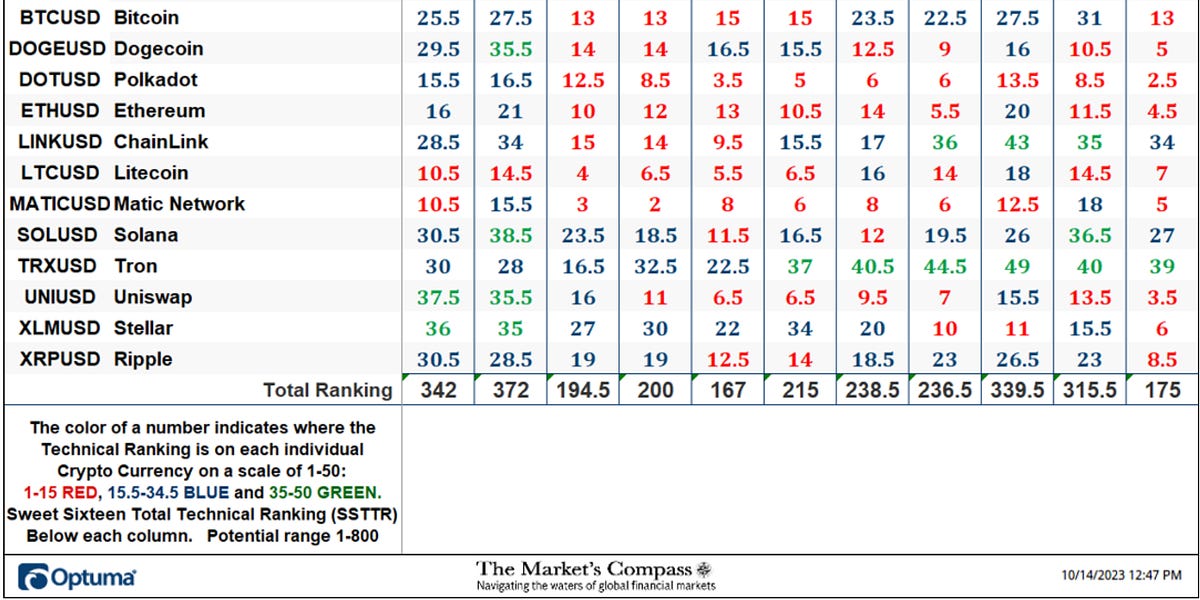

The Excel spreadsheet below indicates the weekly change in the objective Technical Ranking (“TR”) of each individual Cryptocurrency. The technical ranking or scoring system is an entirely quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength. If an individual Cryptocurrency’s technical condition improves the Technical Ranking (“TR”) rises, and conversely, if the technical condition continues to deteriorate, the TR falls. The TR of each individual Cryptocurrency can range from 0 to 50. The spreadsheet below also acts as a “heat map” in that, cryptocurrencies with a TR in the range of 1 to 15 are highlighted in red, 15.5 to 34.5 are noted in blue and TRs in the range of 35 to 50 are in green. The primary take-away from this spread sheet should be the trend of the individual TRs, either the continued improvement or deterioration, as well as a change in direction. A sustained trend change needs to unfold in the individual TRs for it to be actionable. Secondarily a very low ranking can signal an oversold condition and conversely a continued very high number can be viewed as an overbought condition but, as we know, over sold conditions can continue at apace and overbought securities that have exhibited extraordinary momentum can easily become more overbought. Thirdly, the weekly TRs are a valuable relative strength/weakness indicator vs. each other, in addition when the Sweet Sixteen Total Technical Ranking (“SSTTR”), that has a range of 0 to 800, is near the bottom of its range and an individual cryptocurrency has a TR that remains elevated it speaks to relative strength. Conversely if the SSTTR is near the top of its recent range and an individual cryptocurrency has a TR that remains mired at low levels it speaks to relative weakness. Lastly I view the objective Technical Rankings as a starting point in my analysis and it is not the entire “end game”.

*Rankings are calculated up to the week ending Friday October 13th

The SSTTR fell -44.53% to 175 from the previous reading of 315.5 for the week ending October 6th which had fallen slightly from the last week in September at 339.5. As will be seen in the spreadsheet below the losses in individual Technical Rankings (“TRs”) was broad based, driving the SSTTR to a level not seen since September 1st.

On a week over week basis all of the Sweet Sixteen Cryptocurrencies registered losses in their individual TRs. The average TR loss was -8.78. Leading the field lower was Bitcoin (BTC) which lost -18 “handles” to 13 from 31 followed by Avalance (AVAX) which dropped -16.5 to 6 from 22.5. Only one of the Sweet Sixteen ended the week in the “green zone” (TRs between 35 and 50). That was Tron (TRX) which saw its TR only shaved by -1 to 39 from 40. Two were in the “blue zone” (TRs between 15.5 and 34.5) and thirteen ended the week in the “red zone” (TRs between 1 and 15). The previous week ending October 6th, there were three cryptocurrencies in the “green zone’ (that included TRX), six were in the “blue zone” and seven were in the “red zone”. The positive relative strength of TRX vs. the CCi30 Index (green arrow in lower panel), since its price low in August can be seen in the chart posted below.

*Friday October 6th to Friday October 13th

AVAX and Matic Network (MATIC) led the pack lower with a seven day absolute loss of -14.08% and -8.67% respectively and in doing so helping to drive the average seven day absolute loss of the Sweet Sixteen to -6.48%. Daily charts of both are posted below, note the short term loss of price momentum as witnessed by MACD. TRX’s -1.96% loss almost seems de minimis compared to the losses in the other Sweet Sixteen Cryptocurrencies.

There are eight Technical Condition Factors (“TCFs”) that determine individual TR scores (0-50). Each of these 8, ask objective technical questions (see the spreadsheet posted above). If a technical question is positive an additional point is added to the individual TR. Conversely if the technical question is negative, it receives a “0”. A few TCFs carry more weight than the others such as the Weekly Trend Factor and the Weekly Momentum Factor in compiling each individual TR of each of the 16 Cryptocurrencies. Because of that, the excel sheet above calculates each factor’s weekly reading as a percent of the possible total. For example, there are 7 considerations (or questions) in the Daily Momentum Technical Condition Factor (“DMTCF”) of the 16 Cryptocurrencies ETFs (or 7 X 16) for a possible range of 0-112 if all 16 had fulfilled the DMTCF criteria the reading would be 112 or 100%. A DMTCF reading at 85% and above suggests a short-term overbought condition is developing and a reading of 15% and below suggests a short-term oversold condition.

At the end of last week the DMTCF fell to 11.61% or 13 out of 112 points. This week’s oversold reading was a drop from the overbought reading of 93.75% or 105 three weeks ago.

As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 16 Cryptocurrencies are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely, if more of the TCFs fall on a week over week basis, more of the “Cryptos” are deteriorating on a technical basis confirming the broader market move lower. Last week all eight TCFs fell adding further evidence of broad based technical weakness in the Cryptocurrency market.

The Sweet Sixteen Total Technical Ranking (“SSTTR”) Indicator is a total of all 16 Cryptocurrency rankings and can be looked at as a confirmation/divergence indicator as well as an overbought / oversold indicator. As a confirmation/divergence tool: If the broader market as measured by the CCi30 Index continues to rally without a commensurate move or higher move in the SSTTR the continued rally in the CCi30 Index becomes increasingly in jeopardy. Conversely, if the CCi30 Index continues to print lower lows and there is little change or a building improvement in the SSTTR a positive divergence is registered. This is, in a fashion, is like a traditional A/D Line. As an overbought/oversold indicator: The closer the SSTTR gets to the 800 level (all 16 Cryptocurrencies having a TR of 50) “things can’t get much better technically” and a growing number individual Crypto’s have become “stretched” there is more of a chance of a pullback in the CCi30. On the flip side the closer to an extreme low “things can’t get much worse technically” and a growing number of Crypto’s are “washed out technically” and an oversold rally or measurable low is closer to being in place. The 13-week exponential moving average in Red smooths the volatile SSTTR readings and analytically is a better indicator of trend.

*The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

The CCi30 Index fell -4.93% last week after being capped by the Median Line (red dashed line) of the Schiff Modified Pitchfork (red P1 through P3) for the eighth week in a row. The SSTTR fell as well and is “closing in” on what has been oscillators low during what I continue to believe is a base building process. The 13-Week Exponential Moving Average of the SSTTR continues to track lower. MACD of the Crypto Index continues to track below its signal line at just below neutral territory giving little hint as to the directional bias. Unless support offered first, by price support at 6,580 and then by the Lower Parallel of the Pitchfork is violated, I will stick with my technical thesis that the price action continues to be base building.

The Weekly Average Sweet Sixteen Technical Ranking (“ASSTR”) is the average Technical Ranking of the sixteen Crypto Currencies I track in this Blog. Like the SSTTR, it is a confirmation/divergence or overbought/oversold indicator.

The slightly shorter-term Weekly Cloud chart adds little additional technical clues as to where the index will be heading in the weeks that come. What I can say is that with a twist in the Cloud approaching in the middle of November there will be a chance that Cloud resistance will dissipate, reducing one of the barriers to recovery but the index must first “deal” with resistance at tha Median Line (purple dotted line) of the Pitchfork that has continued to cap rallies). At the end of last week the ASSTR was approaching a level that has led to short-term price reversals.

Charts are courtesy of Optuma whose charting software enables anyone to visualize any data including my Objective Technical Rankings. Cryptocurrency price data is courtesy of Kraken.

The following links are an introduction and an in depth tutorial on RRG Charts…

https://www.optuma.com/videos/introduction-to-rrg/

https://www.optuma.com/videos/optuma-webinar-2-rrgs/

To receive a 30-day trial of Optuma charting software go to…

[ad_2]

#Markets #Compass #Crypto #Sweet #Sixteen #Study

Source link

Related posts: