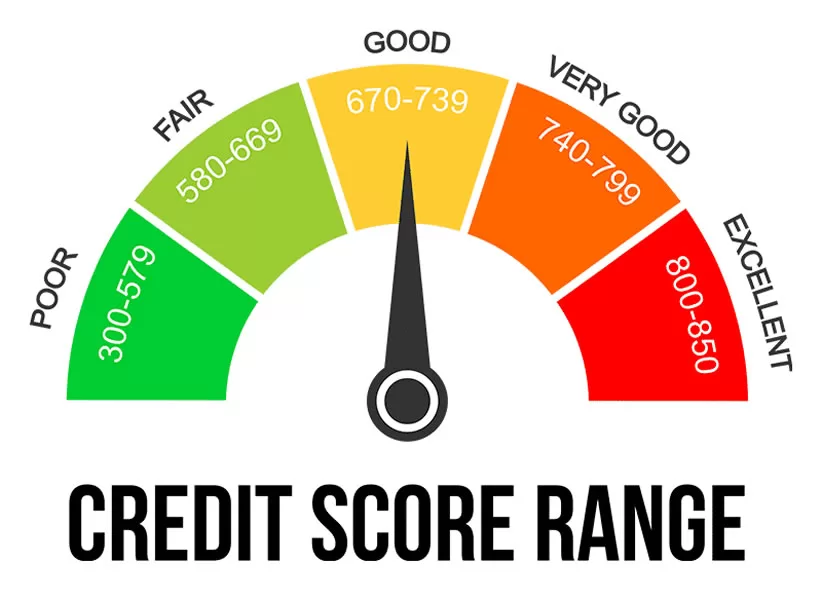

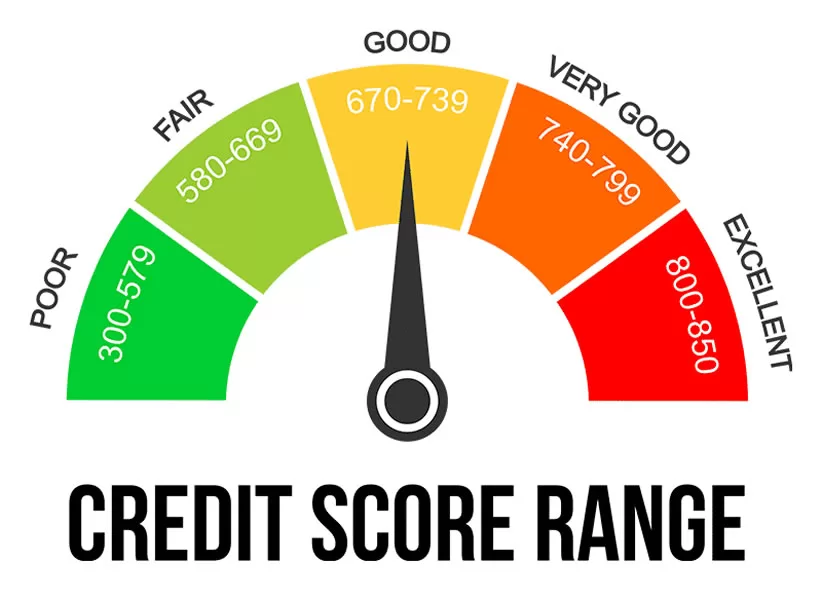

Minimum Credit Score: When it comes to borrowing money, having a good credit score is essential. Lenders use credit scores to determine the risk of lending money to an individual. The higher the credit score, the more likely a person is to be approved for a loan and receive favourable terms. On the other hand, a low credit score can make it difficult to secure a loan or result in higher interest rates.

Understanding the minimum credit score requirements for borrowing money is crucial for anyone looking to take out a loan or line of credit. Here are a few key points to keep in mind:

1. Different Types of Loans Have Different Credit Score Requirements

Different types of loans have different minimum credit score requirements. For example, conventional mortgage loans typically require a minimum credit score of 620, while FHA loans may accept borrowers with a credit score as low as 500 (with additional requirements). Personal loans, auto loans, and credit cards also have varying credit score requirements.

2. Lenders Have Their Criteria

In addition to the minimum credit score requirements set by loan types, lenders may have their criteria for borrowers. Some lenders may be more flexible with credit scores, while others may have stricter requirements. It’s important to shop around and compare lenders to find one that is willing to work with your credit score.

3. Credit Scores are Not the Only Factor

While credit scores play a significant role in the borrowing process, they are not the only factor lenders consider. Income, employment history, debt-to-income ratio, and other financial factors also play a role in the approval process. A strong financial profile can sometimes compensate for a lower credit score.

4. Improving Your Credit Score

If your credit score is not where it needs to be to qualify for a loan, it’s important to work on improving it. This may involve paying down debt, making on-time payments, and addressing any errors on your credit report. Additionally, there are credit-building tools and resources available to help individuals improve their credit scores over time.

5. Options for Borrowers with Low Credit Scores

For borrowers with low credit scores, there are still options available. Some lenders specialize in working with individuals who have less-than-perfect credit. Additionally, secured loans and credit cards can help borrowers build credit and improve their financial standing over time.

In conclusion, understanding the minimum credit score requirements for borrowing money is crucial for anyone in need of a loan or line of credit. Knowing the minimum credit score requirements for different types of loans, shopping around for lenders, and working on improving your credit score are all important steps in the borrowing process. By being aware of the minimum credit score requirements and taking steps to improve your financial profile, you can increase your chances of qualifying for a loan and receiving favourable terms.

#Understanding #Minimum #Credit #Score #Requirements #Borrowing #Money,